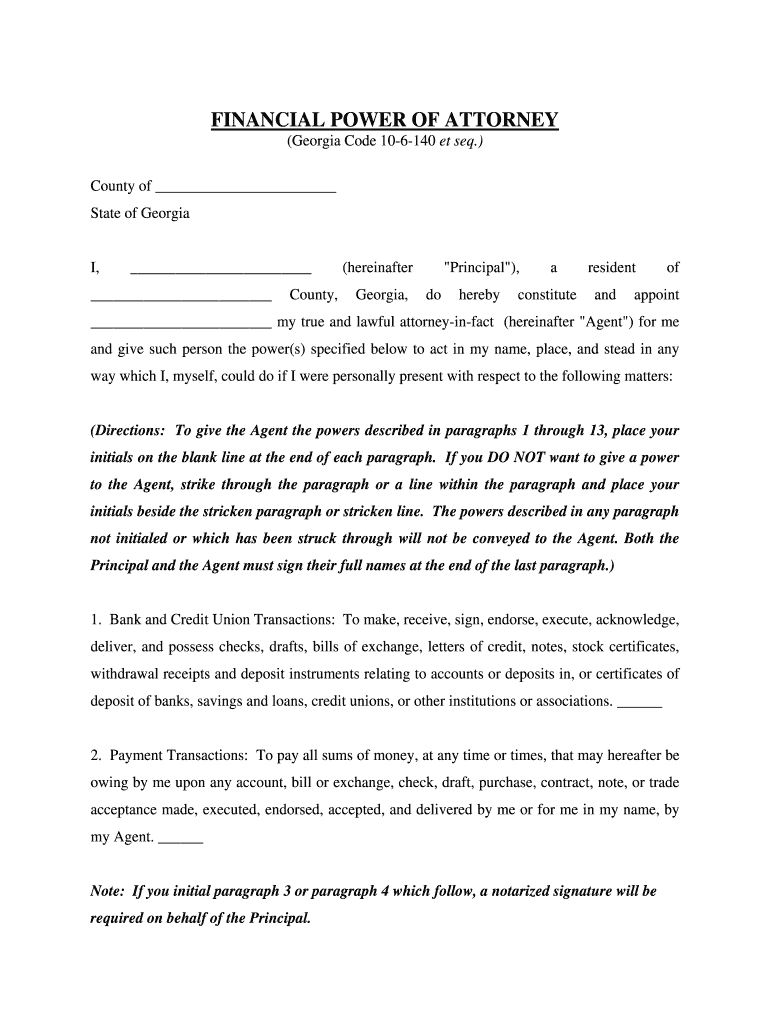

It is often used for a specific transaction, such as buying or selling property. This type of power of attorney grants limited authority to the agent to act on behalf of the principal in specific situations or for a specific period of time. Limited Power of AttorneyĪnother type is the limited power of attorney. It is typically used for short-term situations and is terminated when the principal becomes incapacitated or dies. This type of power of attorney grants broad authority to the agent to act for the principal in various legal and financial matters. Several types of power of attorney can be used depending on the circumstances. The agent must have the necessary skills and knowledge to carry out the duties assigned to them and must act in the best interests of the principal at all times. Once the power of attorney document has been created, the principal must choose an agent who they trust to manage their affairs. It is important to understand how power of attorney works because it grants significant powers to the agent and can have a significant impact on the principal's finances, property, and personal affairs. This legal arrangement is useful in situations where the principal cannot decide for themselves due to illness, injury, or absence. Proudly serving clients throughout Orange County, Financial Relief Law Center, APC offers legal assistance in both English and Spanish.A power of attorney is a legal document that authorizes an individual to act as a representative of another person in specific circumstances.Īn individual who grants the power of attorney is called the principal, whereas the individual acting on their behalf is known as the agent or attorney-in-fact. We can draft the specific power of attorney based on your unique needs. This is especially helpful in terminal and nonterminal cases, such as disclosure of medical records.Ĭonsequences of not having a durable power of attorney include having to petition a court to appoint a guardian of the estate to make property decisions for a person who is incapacitated or disabled. Like a financial power of attorney, a durable power of attorney for property appoints an agent to make certain decisions concerning property and financial management.Ī health care power of attorney allows an agent to make health care decisions on behalf of a principal who is unable to make those decisions for him or herself. Like probate, these proceedings can be costly, protracted and embarrassing for those involved. Typically, this power of attorney can be used for property or health care. A durable power of attorney, however, survives death or incapacity. Durable Power of Attorneyĭurable powers of attorney, like other powers of attorney, are a written agreement whereby a principal designates an agent to act on his or her behalf. Generally handling financial matters on your behalfĪ financial power of attorney can make sure you do not fall behind on important financial matters in the unfortunate circumstances that you are unable to make these important decisions for yourself.Collecting insurance or government benefits.With a financial POA, your agent is allowed to take care of your finances when you are unable to, including: There are different types of power of attorneys, one of the most common of which is a financial power of attorney.

Limited Power of AttorneyĪ limited power of attorney is a power of attorney that is narrowed for a specific purpose such as buying a home.

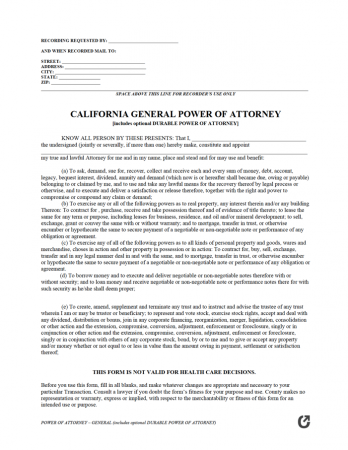

A general power of attorney may be revoked by the principal by giving notice.

The principal gives the agent the power to do anything that the principal could do. It is the broadest power a person can give another person. A general power of attorney is a legal document that gives an agent (delegated person) authority to act on behalf of a principal (the maker of the document).

0 kommentar(er)

0 kommentar(er)